One of the worst things that can happen when you are selling a business, especially a middle market company, is failed negotiations (after months of working hard on it) caused by gaps, loopholes, and missteps, or unnecessary and avoidable delays at the very least.

To be able to sell at the best possible valuation and ensure that everything goes smoothly, a key part is doing due diligence – inspecting all parts of the business to show potential buyers that it is a good investment.

Due diligence helps identify any issues, ensures all possible questions are answered, and manages the expectations of the buyers. To guide you through the process, we created a checklist that covers financial statements, legal papers, and more.

Key Takeaways

- Before selling your business, check all parts of it such as finance records, contracts, and how things work every day. This helps identify issues that could lower the business valuation.

- Keep all vital company information secure with passwords and limit access as necessary. Have a nondisclosure agreement in place when sharing details with potential buyers.

- Identify and fix any known issues in your business before trying to sell it. This includes issues in finances and updating legal documents like contracts.

- Show clear records of what your business earns and spends, including tax returns and debt details to make sure buyers know the financial health of your business.

- Make sure you understand details about the company, how it operates daily, and have all legal paperwork in order including licenses and permits needed to run the business legally.

What is Due Diligence in a Business Sale?

Due diligence in a business sale assists a company in preparation to sell by identifying and resolving potential challenges, risks and liabilities while showcasing the business positively to prospective buyers.

This is where due diligence will help make a business sale as smooth as possible.

It requires a company’s financial statements, tax returns, and contracts. The day-to-day operations of the company and its position in the market are also assessed. They check for the existence of problems or possible growth.

In this way, they can determine if it is a good business to buy or not.

Importance of Due Diligence When Selling a Business

Knowing what due diligence is provides the context. Now we see why it is so important in a business sale. Sellers need to demonstrate that their business is worth what they are claiming. This process checks value and spots major problems.

This step creates marketing material to attract good buyers. It helps identify who actually can buy your business. Over 90% of the work here would be to guess what kind of information the buyers would want and serve it neatly.

Due diligence involves research into money matters, legal stuff, how things work day-to-day, client details, asset information, and team facts before selling.

It makes a lot of sense to understand the reason behind selling too. It goes without saying that transparency and preserving the business is paramount while doing this. Having a guide/checklist is of tremendous help to sellers during these processes, ensuring everything—money records, contracts involving clients or workers, disputes with laws or patents liable to arise later—are provided to the buyer to let them make the right call.

Preparing for the Due Diligence Process

Preparation for the due diligence process means that you set up things in a manner to present your business in the best form. Read ahead to know how you may make this process easier.

Due diligence contact person

You should choose one person in your company that you will discuss with the buyers. This person has got to be knowledgeable enough regarding your business. He gives out information and answers queries from people who are inquisitive about purchasing your business.

This way, everyone gets the same answers. It keeps things clear and simple.

This contact person works closely with your team of advisors, lawyers, and accountants. They ensure that all the important documents are ready for review. These include financial statements, contracts, and details about employees.

Organizing everything is key in due diligence when selling a business.

Get a team of advisors

Have a team of experts who understand the business of selling a business. This should include a lawyer, an accountant, and possibly a business broker. The lawyer would review the legal documents – contracts and agreements – to make sure everything is in order.

An accountant can support the statement by showing actual health in income statements and cash flow reports, while a business broker may assist in finding a buyer and facilitating deal-making.

It involves experts in different fields ensuring all aspects of the sale are covered. They then apply checklists such as due diligence checklist guided by the sell-side M&A process in checking out every detail.

This team helps you get ready for what buyers want to know and make your company look good for sale.

Protect your company’s information

Now, you need to maintain the secrecy of details relating to your company. There is an NDA, which ensures that nobody looks at your business without taking the assurance not to talk about it.

In fact, it is almost making a promise not to talk about it.

Use strong passwords and change them frequently on all accounts of your firm. These accounts include those for emails, financial files, and customer data. Online storage or cloud providers are good places to house sensitive information, such as tax returns, income statements, and client contracts.

Only key employees and consultants should have access to the secure places.

Check on who can see important papers regularly. Change them as needed to keep things safe. Selling your business means sharing lots of info but making sure it stays in the right hands is crucial.

Fix known issues before starting

Now that your business information is in good hands, it is now time to address any problems right away. Huge and small problems make the business appear attractive to sellers. Look at your numbers first.

Make sure all your income statements and your balance sheets are clean and correct. If there’s a mistake, correct the mistake before other people even look at it.

Legal Stuff

Update all contracts and agreements. Inspect licenses and permits, too. Doing these shows buyers you are serious.

Lastly, do not forget what you owe and what you own. Clear out debts that might scare the buyers away. Fix or get rid of broken equipment and machinery, too. Taking care of these early puts you in a great position to sell your business.

Financial Due Diligence Checklist

The money side of things, you want to check it out when selling your business. You will look for income and cash flow making sure everything adds up rightly.

Profit and loss statement

A profit and loss statement is essential in defining the health of a given business. It shows incomes and expenses. This goes a long way in telling the buyer how the business has been over time. Here is a simple illustration of what they contain:

Here’s a simplified look at what they include:

| Year | Income | Expenses | Net Profit |

| 2021 | $500,000 | $300,000 | $200,000 |

| 2022 | $550,000 | $320,000 | $230,000 |

These records are pretty obvious. They indicate growth or issues. This is what most buyers want to see. It helps make the decision.

Tax returns and filings

Tax returns and filings come in next.

Tax returns and filings are almost like the backbone of your business’s financial health. You have to present these to the buyer. These show how much money your business made and paid in taxes. This information allows the buyer to see the profit history of your business. Let’s break this down simply:

| Document | Why It’s Important |

| Last three years’ tax returns | Shows the business’s earnings and tax payments over time. |

| State and federal filings | Confirms the business meets all tax laws. |

| Sales tax licenses | Proves the business can legally sell products or services. |

| Employment tax filings | Shows the business follows rules for paying workers. |

This table keeps things clear. Every paper is there for a purpose. They all prove that your business is legitimate. The buyer wants this evidence. It makes them feel safe to buy your business. So, get those papers ready. Show the buyer your business is worth it.

Accounts receivable and payable

Accounts receivable and payable are the heart of the financial well-being of a business. This section looks at money owed by customers and money the business needs to pay. Let’s break it down in a simple table:

| Type | Description |

| Accounts Receivable | Money to be received from customers for goods or services. |

| Accounts Payable | Money due to suppliers or creditors. |

This shows two main things: what’s coming in and what’s going out. Keeping track of this helps a business understand its cash flow. It’s crucial for the sale process. Why? Buyers want to see clear records. They check if the business gets paid on time. They also check if the business pays its bills on time.

Ensure these records are in up-to-date order. Fixing the mistakes makes business seem appealing to buyers. Finally, let’s glance over the debt and loan documentation.

Debt and Loan Documentation

Present all the money your business owes. That is to say, listing all loans and debts, big or small. You have to present loan agreements and how much you still have to pay back. Include terms of loans, interest rates, and deadlines for payments. Buyers want to see this information. They check if your business can pay debts on time.

Now, let’s discuss Operational Due Diligence.

Operational Due Diligence Checklist

Operational due diligence reviews how your business runs on a day-to-day basis. This looks at systems, supply chains, and how you create or deliver what you sell.

Business structure and ownership

Selling your business starts with knowing its structure and who owns it. This part might sound simple, but it’s crucial. Your business could be a sole proprietorship, partnership, corporation, or LLC (Limited Liability Company).

Each will affect how you sell the business and share information during due diligence. For example, if you have partners or other shareholders, they must agree to the sale.

You also have to list all the owners and their shares in the company. This way, the buyer will know who they are dealing with and will make the legal procedures easier later on. Along with the ownership details, attach any articles of incorporation or similar documents that prove your right to decide on the sale of the business.

These papers are key pieces in financial and legal checks during due diligence.

Lastly, updating this information before beginning due diligence clears everything better for potential buyers. It gives them an idea of exactly what they can buy and who is likely going to receive money from the sale.

Such clarity will hasten decisions and close deals sooner.

Key operational processes

Let’s discuss how the business runs every day from who owns and controls the business. Key operational processes are like the engine of a car; they keep everything running smoothly. How products get made, orders get filled, and questions are answered by customer service are all part of keeping customers happy and coming back.

For example, supply chain management assures the availability of all parts required to make products at the right time. This can be with suppliers in close coordination or even through smart systems keeping track of inventory.

On the other hand, record-handling processes for sales allow one to know the best-selling products. To a business buyer, this will be very valuable knowledge.

The products must also be of good quality. Thus, businesses normally have procedures to check the quality of the product before it reaches the customer. This may involve testing every product or ensuring that the workers making them follow certain standards.

Agreements with suppliers and vendors

Verify your supplier and vendor agreements. These papers inform you of deals with the companies that give you goods or services. They are as important for running your business efficiently and effectively. You need to know who gives what, how much it costs, and when they deliver.

Make a list of all the agreements. Record details like terms and payment schedules. This will enhance your understanding of your supply chain. When there are issues fix them before selling your business.

Buyers like seeing solid relationships with suppliers and vendors.

Inventory and supply chain management

Manage inventory and the supply chain well to ensure you are ready to sell. It shows how well you handle goods from suppliers to customers. A smooth system keeps costs down and meets demand fast.

In the due diligence checklist, include records of inventory levels, supplier contracts, and logistics plans. This info helps buyers see your business can deliver products on time without wasting resources.

Also, a relatively modern system of IT for observing stocks and orders is of great importance. It makes work easier while reducing errors in counting or shipments of goods. Add details about these technologies to your sales documentation.

Thus, by the above actions, you ensure your customers see the strength of the management of supply chains.

Legal Due Diligence Checklist

Legal Due Diligence confirms all legal documents. This process includes checking contracts, permissions, and other court cases. It also covers the ideas and inventions owned by the business.

These are the most salient legal details.

Contracts and agreements

You need to carefully review all of your contracts and deals. This will include sales agreements, loan papers, leases, and non-compete terms. Know what each of these contracts says. Understanding how each of these affects the selling of your business is also key.

Ensure that all deals are current and valid. Be wary of those deals that would not easily transfer to the new owner. Some contracts may end upon a change in ownership, or they may require consent from the other party for a new owner to take over.

Also, get your employee contracts and benefits information. Know who has promised what. Check if there are retirement plans or health insurance promises you must keep up with even after selling.

Having everything in order makes your business look good to buyers. It shows you’re serious and have taken care of things well.

Licenses and permits

From contracts and agreements, licenses and permits are next. These documents are essential. They demonstrate that your business is operating according to the law in your area, in your state, and nationally. You would need proper licenses to legally operate your business.

This could include permits to sell particular products or services. It also covers health and safety approvals.

Check what type of license your business needs. It might be a basic operating permit or something more specific like a liquor license. Make sure they’re all up to date before you plan to sell your business.

Buyers will want to see these documents during due diligence checks. They show that the business is legal and ready to go.

Ongoing or potential legal disputes

Check for any legal fights your business may face now or later. These could involve problems with contracts, claims from people hurt by your products, or fights over who owns ideas or inventions.

Having these issues can scare off buyers and lower the price they’re willing to pay. Keep all records of legal matters sorted and easy to show. This includes both settled cases and those still in court.

Next, gather details on patents, copyrights, and trademarks in the Intellectual property documentation section.

Intellectual property documentation

Intellectual property, or IP, is a big part of your business. It includes things like trade secrets, brand identity, and products. You need to show all your IP documents to the buyer.

This means listing patents, copyrights, and trademarks. Show any legal fights over IP too. If you made software or tech stuff with others, include those deals.

Keeping good records proves your business owns its ideas and creations. This can make your company more valuable. Buyers want to be sure they won’t face surprise legal issues after they buy.

Next up is Employee and HR Due Diligence…

Employee and HR Due Diligence Checklist

Checking your team and HR practices is key before selling your business. This includes looking at contracts, pay setups, job performance data, and rules to make sure everything’s in order.

Employee contracts and benefits

Check out employee contracts and benefits closely. These include pay, health insurance, and retirement plans. See how these fit with current laws. Make sure there are no errors in the contracts.

Also, understand all job deals. Know what each worker gets from their work deal. Look at their salary and extra perks like bonuses or health care options. This helps you see if the business follows the rules on paying people and giving them benefits.

Compensation structuresCompensation structures are key in keeping your team happy and productive. This part talks about how you pay and reward your employees. Think about salaries, hourly wages, bonuses, and benefits like health insurance or retirement plans.

Each choice has a big impact on your business’s budget and how appealing it is to work there.

Many companies also look at employee performance data to decide on raises or bonuses. This helps make sure people who work hard get recognized. It’s important for selling your business too.

Buyers want to see that you have a fair system that rewards good work because it means the team is likely to stick around after the sale.

Employee performance data

Getting the right details on how workers are doing is a big part of selling your business. This info shows who is doing great and who might need more help or training. You’ll want to have records like yearly reviews, sales numbers, and any awards or special recognitions employees have gotten.

This data helps buyers understand the team they’re getting. They can see which departments are strong and where they might need to put in more work.

Having clear records of employee growth and turnover rates also matters a lot. Buyers look at these numbers to guess how well the business will do after they buy it. High turnover could be a red flag, showing problems that could make the business hard to run later on.

On the other hand, signs of employees staying long and moving up in the company can mean it’s a good place with happy workers. This makes your business look better to potential buyers.

So, keep track of all this performance info before you start selling your business. It adds value by showing that you understand your team’s strengths and challenges. And it gives buyers confidence that they’re making a smart choice.

Workplace policies and compliance

Workplace policies and compliance cover how a business treats its workers. This includes the rules for how employees should act, the benefits they get, and their pay structure. It’s about making sure everyone is treated fairly and follows laws.

For selling your business, it’s key to have employee contracts that are clear and up-to-date. These documents show what workers agreed to when they were hired.

You also need to check that your company follows all job-related laws. This means looking at things like overtime pay, breaks, and safety rules. Making sure you do this can prevent legal problems later on.

Next up is checking into your customers and market…

Customer and Market Due Diligence Checklist

In customer and market checks, you get a clear picture of who buys your stuff and why. You also see how your business stands in the busy market—like if you’re leading or need to catch up.

Client contracts and agreements

Client contracts and deals show who buys your products or services. They also tell how long they will do so. This info is key for anyone wanting to buy your business. These documents can help a buyer see if customers will stay after the sale.

Make sure these papers are easy to read and up-to-date.

Deals with clients often include details about prices, delivery times, and what happens if things go wrong. If you sell your business, the new owner needs to know about these agreements.

They’ll want to keep good relationships with existing customers. Plus, they might see chances to grow or improve deals based on this info.

Customer retention data

Customer retention data shows how well a business keeps its customers over time. This info is key when selling a business. Buyers want to see that people come back to use your products or services again and again.

High customer retention rates often mean the business has loyal customers and steady sales. It can also suggest that the company’s marketing plan works well.

You should collect data on how many new customers you get, how many stay, and for how long they stick around. Also, find out why some leave and try to fix those problems before you sell the business.

This effort can make your company more attractive to buyers. They see it as less of a risk if they know they’re getting into a stable market with happy customers.

Market research and competition analysis

Market research and competition analysis are key steps in selling your business. They help you understand where your business stands in the market. You look at what others in your field are doing.

This way, you see how to set your prices or find new customers. Tools like surveys and focus groups can show what people think about your products or services.

Understanding the market also shows if there’s room for growth. Maybe there’s a trend you haven’t thought of yet. Or a need that no one is meeting. This info helps buyers see the value of buying your company.

You also take a good look at who you’re competing against. Find out their strengths and weaknesses. See what they do well and where they could improve. This tells you how to make your business better before selling it.

This work might show why some customers pick you over others. It can point out why some areas of your business do really well while others don’t.

Distribution channels

Selling your business means looking at how you get your products to customers. This part is all about distribution channels. They are the paths you take to sell what you offer. Some companies use direct sales, selling straight to their customers online or in stores they own.

Others might sell through partners like shops or online platforms.

You need a good plan for these channels when selling your business. Buyers want to know how well your ways work and if they can make them better. For example, if most of your sales come from the internet, show how strong your online presence is.

If shops play a big role, explain those relationships and agreements. Make sure everything is clear and organized so buyers can see the value easily.

Physical and Real Assets Due Diligence Checklist

Checking your property and equipment is key to selling a business. This step makes sure what you own is ready for the new owner. Want to find out more? Keep reading!

Real estate holdings

Real estate holdings are a big part of selling your business. This includes land and buildings you own. You need to show these assets clearly to the buyer. Make sure all your property papers are correct and up-to-date.

Include details about mortgages or loans linked to the real estate.

Also, list any insurance coverage for your properties. This shows buyers how well you take care of your assets. If there are any problems with the property, fix them before you sell.

Next, we will talk about equipment and machinery in the business.

Equipment and machinery

Moving from real estate to the tools and machines a business uses, this part is just as key. These items are what help make products or offer services. So, making sure they’re in good shape is important.

You need to list all your equipment and machinery. This includes everything from computers and software (like SaaS) to production tools.

You also have to show their value and condition. Are they almost new or pretty old? Do you own them free and clear, or are there loans against them? Having this info helps buyers understand what they’re getting into.

They’ll see if they need to buy new stuff soon or if what you have will last a while longer.

Lastly, keep records of maintenance up-to-date. Prove that you take care of your gear by showing regular check-ups and fixes. This gives confidence that things won’t break down right after buying the business.

Maintenance records

After looking at equipment and tools, it’s key to focus on how well they’ve been kept up. Keeping track of maintenance is like keeping a health record for your business’s physical assets.

This info shows buyers that you care about your gear and buildings. It can make or break a deal.

Maintenance logs tell a story. They show how often repairs were done and how much was spent on them. They also reveal if the assets are in good shape or if they might cause problems later.

Make sure these records are easy to read and up-to-date. This will help prove your business is worth buying.

Insurance policies

Check your insurance policies. Make sure they cover all areas of your business. This includes property, employees, and any special risks unique to your work. Buyers will want to know that you have the right insurance coverage.

They look at this to avoid any surprises after buying the business.

After reviewing insurance, consider physical and real assets next.

Moving through the due diligence process needs a clear plan and quick answers to buyer’s requests. Keep a detailed list of all documents you give to buyers, and talk terms wisely to close the deal smoothly.

Responding to buyer requests

Selling a business means getting lots of questions from buyers. They want to know everything before they decide to buy. You need to be ready with all the documents and answers. This includes financial statements, tax returns, and legal papers.

Also, they will ask about how your business runs, who your customers are, and what assets you have.

To make things smooth, keep records of all the documents you give them. It shows you are open and honest. If there’s a problem or concern from the buyer’s side, talk it out. Find a good solution that works for both sides.

You also need to listen carefully to what the buyers ask for. Give clear answers quickly but accurately. This helps in making sure both you and the buyer understand each other well during this big change.

Keeping records of submitted documentation

Keeping good records of all the papers you give to the buyer is key. Use a secure digital storage space like a cloud service for this. It makes sharing files with buyers safe and easy.

Also, list every document you hand over. This list helps if there’s confusion later about what was shared. It includes contracts, financial statements, employee details, and more.

This method shows you’re honest about your business’ health. It also speeds up the due diligence process. Buyers can quickly see what they need to know about your company. They look at tax returns, loan agreements, insurance policies, and more without delays.

This smooth flow of information can lead to better talks on selling your business.

Negotiating terms effectively

Negotiating terms takes skill and a clear plan. Know what you want out of the deal. This means setting clear goals based on your business valuation, financial statements, and other key documents.

It’s smart to have a list of must-haves and nice-to-haves before talks start. Use this list as a guide during discussions.

Talk openly with buyers but stay firm on important points. Show them your business’s value through strong financial data, such as income statements and cash flow records. Be ready to explain any part of your due diligence checklist if asked.

This helps both sides understand each other better and moves things forward smoothly.

Now let’s look at how to wrap up the due diligence process effectively.

Final Steps in the Due Diligence Process

In the final steps, you go over all files again, tackle any last concerns from the buyer, and get ready to switch ownership.

Review and finalize documentation

Review each document and record one more time. This approach ensures your financial statements, tax returns, employment agreements, and insurance policies are accurate. Consider it as revising your work before submitting a significant examination.

You want to discover any errors or missing elements now, not later. Verify that everything is present — from the profit and loss statements to the list of physical assets.

Subsequently, make necessary amendments to any document. Did you find an outdated version of an income statement? Update it with the newest figures. Noticed a contract that has expired? Remove it from the stack.

This procedure keeps your paperwork tidy and up-to-date, so purchasers are not perplexed or perturbed by outdated information.

Finally, arrange all these documents neatly. Consider your reaction if someone handed you a box full of jumbled papers versus a systematically organized folder with labels and sections for each category of document: financial docs here, legal papers there…

much improved! This kind of organization demonstrates you’re earnest and prepared for a smooth transaction for selling your business.

Address buyer concerns

Sellers must listen to buyers and clear up their worries. If a buyer is unsure about the business’s money records, sellers should show tax returns, profit margins, and cash flow statements.

This proves the business makes good money. For questions on legal matters, providing contracts, licenses, and info on any court matters helps. It shows the business follows laws.

Handling questions on employees and operations also matters. Sharing details on worker benefits, the roles of key employees, and how the business runs day-to-day can ease worries about taking over.

For all concerns raised by buyers, having clear answers ready speeds up the sale process. This approach can lead to a smooth change of ownership.

Prepare for the transition of ownership

Get everything ready for the new owner. This means making sure all documents are in order. These include financial statements, contracts, and employee information. It’s key for a smooth change to have these things organized and easy to find.

You also need to talk about how the business will run after you leave. Share what you know about running it day-to-day. Explain your systems, like IT setups or supply chain processes.

The goal is to make sure the new owner can keep things going without trouble.

Conclusion

Initiating the sale of your business requires a solid strategy. It’s essential to thoroughly evaluate all aspects of your business including financial specifics and legal documents.

This ensures credibility in the eyes of potential buyers. Assembling a competent team aids in safeguarding sensitive information and resolving issues promptly. Providing pertinent information to prospective buyers is crucial for seamless transactions.

Lastly, adequate preparation for the succession ensures an effective transition. Make preparations today with the expert assistance of ValleyBiggs for an improved sale in the future!

FAQs

1. What is a due diligence checklist for selling a business?

A due diligence checklist for selling a business is a comprehensive list of financial, legal, and operational items that need to be reviewed before finalizing the sale. It includes reviewing financial documents like income statements, balance sheets, cash flow statements, tax returns and audited financial statements.

2. Why do I need to conduct due diligence when selling my business?

Due diligence helps in accurate business valuation and provides potential buyers with an understanding of your company’s operations including supply chain management, inventory control, IT systems and human resources practices. This process reduces risks by revealing potential issues such as weak gross profits or problematic loan agreements.

3. What are some key elements on the operational side of the due diligence checklist?

Key elements include examining products and services offered by your company; assessing marketing plans; checking IT systems efficiency; evaluating employee benefits programs; identifying key employees’ roles; and inspecting physical assets like real estate properties or production cost details.

4. How does legal due diligence factor into this process?

Legal due diligence involves reviewing articles of incorporation to understand the business structure along with other contracts such as distribution agreements, sales agreements or non-compete clauses. It also includes scrutiny of intellectual property rights and trade secrets protection measures.

5. Can you elaborate more on the financial aspects covered in the checklist?

Financial due diligence covers analysis of income statements showing year-to-date earnings; balance sheets reflecting capital structure; cash flow forecasts predicting future profitability rates alongside historical data like past insurance claims records or previous years’ tax returns.

6. What happens after completing all checks from this list?

After all these checks – from gross profit margins evaluation through market penetration studies up until consulting agreement reviews – are completed successfully without any red flags raised then it’s time for drafting a letter of intent (LOI) which signifies both parties’ interest in proceeding with transaction negotiations.

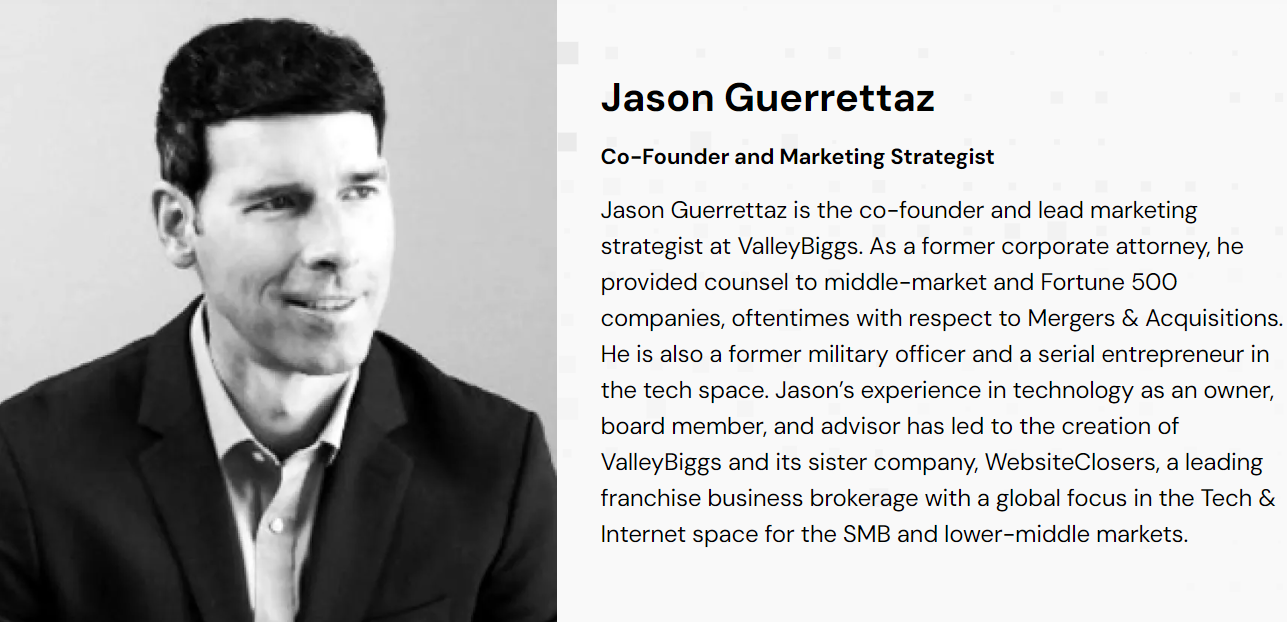

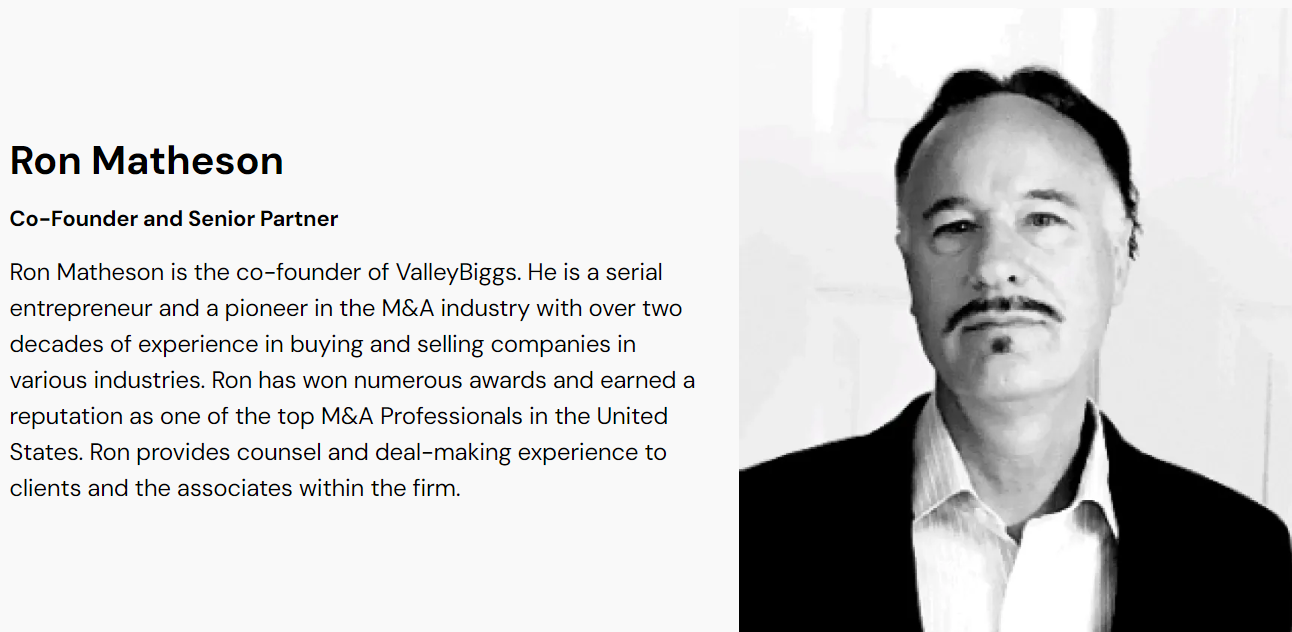

About ValleyBiggs