Selling your business involves many stages in the sell-side M&A process. This article will guide you through essential steps, from preparing for sale to closing the deal and the best ways you can get the desired outcome.

Keep reading to learn more.

Key Takeaways

- Sell-side M&A involves the processes and steps wherein a business owner is looking to divest its business and find an acquirer or buyer. It takes 6 to 9 months and often uses auctions with two bidding rounds.

- Business brokers and advisors play big roles in this process. They help figure out how much the business is worth, set up the sale, and make sure everything follows the law.

- The steps in selling a business include getting it ready for sale, figuring out its value, marketing it to possible buyers, negotiating deals, checking all details carefully (due diligence), and finally closing the deal.

- There are different auction types: broad, limited, and targeted auctions. Each type has its own way of attracting buyers which can affect how much money sellers get for their business.

- Using technology like Virtual Data Rooms (VDRs) helps keep important documents safe during the sell-side M&A process. Financial modeling tools also help understand a company’s value better.

Overview of Sell-Side M&A

Sell-side M&A is about selling companies. Advisors help make these sales happen buy finding the right buyer and getting the best possible outcome.

What is Sell-Side M&A?

Sell-side M&A is all about a business owner/s getting ready to sell their business. This process aims to make as much money as possible for the people who own the company. It takes around six to nine months to finish this whole process.

People often use a two-sided auction with two rounds of bidding here. Sometimes, rules from the government can slow things down.

Investment bankers and business brokers are known for leading the entire effort of the M&A process, from the initial consultation to begin the development of an exit strategy, to the valuation process and then the entire M&A process of selling the business.

Next, we will talk about these roles in more detail.

The Role of Business Brokers and Advisors

Moving on, business brokers, investment bankers, and advisors play key roles in sell-side M&A. These pros are vital for a smooth process. Business brokers work hard to figure out how much a business is worth.

They use different ways to value businesses, like comparing them to similar ones or looking at future money flow. This step ensures the price tag fits.

Next, they help set up the deal structure and give advice on how to finance it and follow rules. Their guidance keeps things moving without legal hiccups. Plus, they offer fairness opinions that defend the board from lawsuits by unhappy shareholders.

Their expertise makes sure every base is covered before sealing the deal.

Detailed Steps in the Sell-Side M&A Process

The sell-side M&A process is like a road trip for your business, where every step moves you closer to your destination – selling the company. This journey includes making the business look its best, figuring out how much it’s worth, finding people who might want to buy it, talking terms with them, checking everything is as it should be, and finally, signing and sealing the deal.

Preparing the Business for Sale

Getting a business ready for sale starts with picking the right team. Lawyers and banks will show why they’re the best choice in what’s known as a beauty contest or bake-off. The company’s own legal team will look at these pitches and choose who to work with.

These pitches include how much the business might be worth, things about the industry, and when everything could happen.

Next is making a sales document. This paper tells possible buyers all they need to know about the business. It talks about how well the company is doing and why it’s valuable. It’s like showing off your best side to attract buyers.

Now let’s get into valuating the business…

Valuating the Business

Finding out how much a business is worth involves a lot of work. You look at money records, what’s happening in the market, and trends in the industry to make a strategic assessment. Making good financial statements helps show buyers your company is solid.

A document called a Confidential Information Memorandum gives them all the details they need about your company.

Valuation methods like discounted cash flow or comparing to similar companies help set the price. This step makes sure sellers and their advisors know what a fair offer looks like before talking to potential buyers.

It’s all about proving your business has great value based on hard facts and numbers, not just guesses.

Related Post: How Much is My 10 Million Dollar Company Worth?

Marketing the Business to Potential Buyers

After giving your business a market value, it’s time to let others know you’re selling. Business brokers play a big role here.

They pull together a list of interested parties/entities that might want to buy your company.

Then, they share this list with you and your team to see if everyone agrees.

First off, potential buyers get something called a teaser presentation. It’s short, just a couple of pages, but it gets them interested.

If they show interest, these buyers get their hands on a much bigger document – the confidential information memorandum (CIM). This beast is over 50 pages long and packed with everything there is to know about what makes your business worth the acquisition.

It’s like giving them the secret recipe without letting out any secrets that aren’t meant for their eyes yet; thanks to what is called non-disclosure agreements (NDAs). These NDAs make sure that whatever is shared stays between those who are meant to see it.

Negotiations with Potential Buyers

Talking to buyers is a big step in selling your business. You and the buyer share details, evaluating the strategic fit, and securing optimal terms. This part is all about back-and-forth talks.

Your financial advisor helps you get through it by planning strategies. These talks can lead to making a deal or finding out you need to look for other buyers.

In this stage, letters of intent come into play. They show serious interest from the buyer but are not final deals yet. These letters list how much they’ll pay and how they plan to do it.

Final bids must be clear on these points too because they are firm offers that can lead to closing the sale if everything goes well during due diligence – where buyers check every detail of your business before signing off on the transaction.

Conducting Due Diligence

Conducting due diligence is a key step in the sell-side M&A process. After picking advisors, setting up an online data room comes next. This step helps acquirers look into the business they want to buy.

It’s about getting ready with marketing stuff and making financial models that show how the business stands out and makes money.

During this stage, meetings with possible buyers happen. There’s also a question-and-answer time. These steps make sure everyone knows what’s going on and can trust the process before they sign any contracts or make deals.

It’s all about checking everything carefully to keep risks low for both sides in the merger or acquisition deal.

Closing the M&A Transaction

To close the M&A transaction, in-house attorneys discuss and agree on the final purchase deal. They choose this after picking the top bidder. Many things decide who gets to be this bidder, like how sure it is that they can close the deal and offers that are all cash.

The advising investment bank gives a fairness opinion (in other words, a professional evaluation) too. This step keeps the board of directors safe from any lawsuits from stock owners.

The closing phase is vital for wrapping up mergers and acquisitions dealings. Here, everything must match what was agreed upon by both parties. This includes all legal papers being right and money transferring as planned.

It’s when both sides finalize their agreement through a sale and purchase contract, making the move official and legally binding.

Different Auction Types in Sell-Side M&A

In sell-side M&A, choosing the right type of auction can make a big difference. Each kind has its way of bringing buyers and sellers together, from broad to targeted auctions.

Exploring Broad Auctions

Broad auctions are a key part of the sell-side M&A process. They involve inviting many potential buyers to bid for a company. This creates more competition. More competition can lead to a higher sale price and better terms for the seller.

It’s like having several customers wanting to buy the same product, which often leads to sellers getting a better deal.

However, there are downsides too. With so many involved, there’s a higher risk that confidential information might leak out. Also, managing bids from multiple parties can take up a lot of time and energy from the company’s leaders.

So, while broad auctions can bring in more money, they do require careful handling to avoid these risks.

Understanding Limited Auctions

Moving from broad to limited auctions, we see a shift in strategy. Limited auctions are for larger companies with a smaller number of potential buyers, around 10-50. This method offers more control over the sale process and keeps things quiet.

It draws several interested parties without making too much noise.

This kind of auction is good because it balances getting high bids with keeping the sale under wraps. The company can talk to a few buyers but still make sure the best deal comes through.

It’s like having the best of both worlds – getting good offers while not stirring up too much attention or trouble in running your business.

Exploring Targeted Auctions

Targeted auctions talk to a few potential buyers, often five or less. This way keeps details quiet and safe. Big companies like this type because it stops too many people from knowing their business plans.

They also don’t want to shake things up too much at work.

A seller picks this way if they care a lot about who knows their business info. They think about how much the company is worth and if the buyer fits well with them. Each step is careful and secret, keeping only a few bidders in the loop.

This choice helps keep everything under wraps better than other ways do.

The Dynamics of Exclusive Negotiation

In exclusive negotiation, a seller talks only with one buyer. This method can make the merger and acquisition (M&A) process quicker. But, it may also lower how much power the seller has in talks.

This is different from auctions where many buyers try to win.

Exclusive deals speed things up because there’s less back-and-forth. Yet, a seller might not get as high a price without other offers on the table. They have to weigh quickness against potential profits carefully.

Pros and Cons of Sell-Side M&A

Sell-side M&A brings its own set of benefits and challenges. On one side, broad auctions could raise the sale price, but exclusive talks can sometimes delay the deal.

Benefits of Broad and Limited Auctions

A broad auction will attract a large amount of interested buyers. This can drive up the price because of competition. Sellers get to talk and negotiate with many different buyers. They might find better deals or learn about other value propositions their business could offer.

A limited or exclusive auction is perfectly apt for big corporations that do not need lots of bidders to select from. In this regard, not too many people know that it’s up for sale. In this manner, the sellers can target only those most likely to buy at a good price without making too much noise in the market.

Problems Associated with Exclusive Negotiations

In exclusive negotiations, sellers are placed in a tricky position. They may get less money for their business because there are few people to bargain with. This type of negotiation also lacks a set timetable with clear steps to suggest what is happening next.

Because there aren’t many buyers, the seller can’t demand a better deal or show off the company’s worth.

The process keeps things secret but this can hurt the seller too. Only one buyer can know about the sale, thus leaving other potential buyers who may offer more out of the deal. This means the seller might end up making less from the sale than they had hoped.

Next, we’ll talk about how technology is changing the game for the sell-side M&A.

How to Improve the Sell-Side M&A Process with Technology

Technically, the sell-side M&A is streamlined by speed and clarity. All important papers are kept safely within the virtual data room, and with financial modeling tools, it’s really easy to calculate the value of a company.

Implementation of Virtual Data Room

Virtual Data Rooms play a significant role in determining safety in the M&A process, making it easier. VDRs maintain private documents securely. This is very helpful while sharing files with a potential buyer or during an audit.

It is like keeping all your important papers in one strong box to which only people you chose may look. You can know who looks at what, making it even safer.

Arrange a VDR properly by putting a list of all the things you would check on due diligence. Ensure proper names for your files so everyone knows what they are reading without confusion. This means maintaining everything organized from the start till closing the deal. Using VDRs means less risk of losing important information and makes talking with buyers smooth.

Role of Financial Modeling

Financial modeling is the heart of M&A deals. It sets the value of a particular company. This way, everyone involved will be able to set the right price. The models watch money coming in and out, risks, and possible outcomes.

This determines how well a company stands based on a host of factors before joining another.

These models use data to enable the presentation of a discussion about a deal and the terms. They are guide instruments for smart choices based on facts rather than guesses. Looking into numbers enables the entrepreneur to find out if the deal makes sense for them.

In this way, they make better decisions that may lead to good fortunes after merging companies or selling one.

Conclusion

Selling a business is a huge undertaking and this is where key advisors, lawyers and business brokers help make the right moves to get the best outcome for the seller. They work on steps such as finding buyers and setting the price. Tools like online rooms keep info safe.

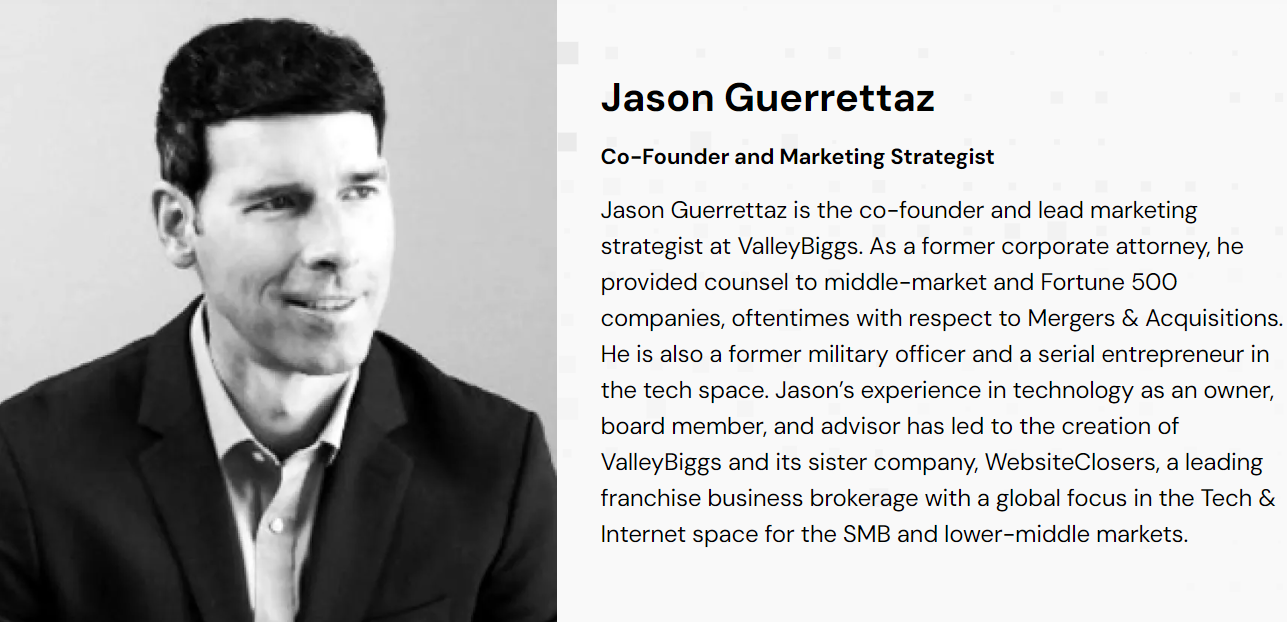

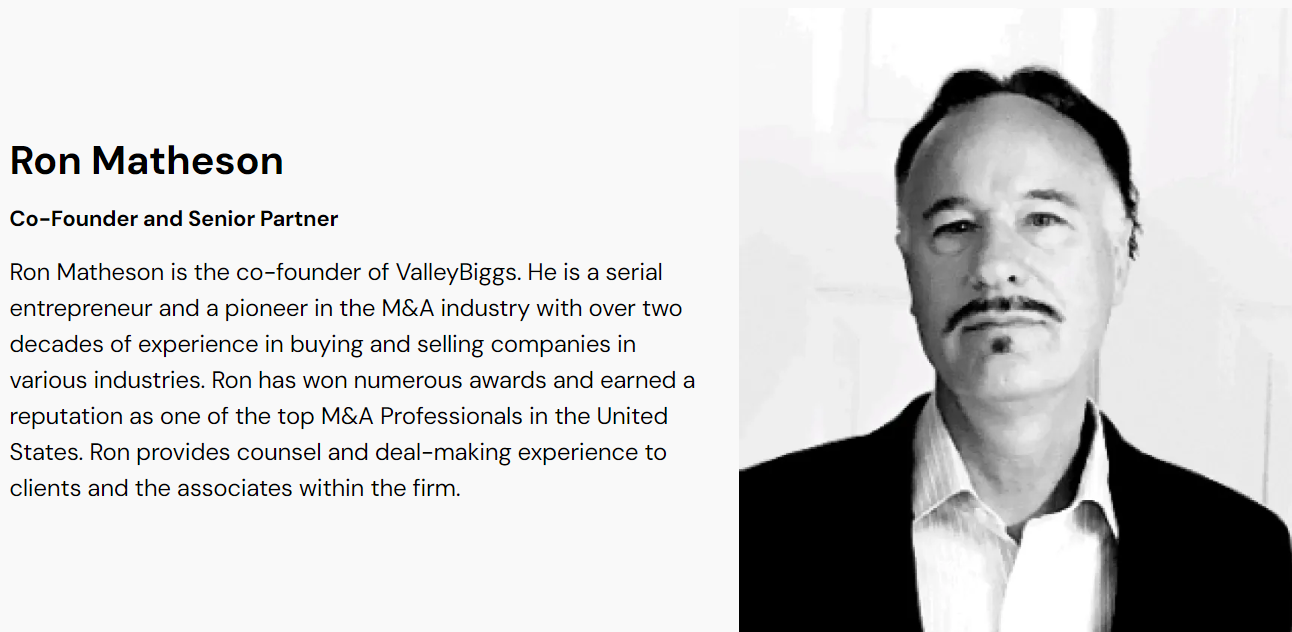

This process takes time but aims to get good deals for owners. In the end, selling smart means more success for everyone involved. At Valley Biggs, we manage the entire sell-side M&A process and have thousands of exits already under our belt through a team of highly trained intermediaries and a massive buyer pool. Contact us today!

FAQs

1. What is sell-side M&A?

Sell-side M&A, short for mergers and acquisitions, is the process where a company or business owner works with an advisory firm to sell their company to another business with the best possible outcome.

2. What are the stages of a typical sell-side M&A process?

The stages include strategic planning, research on market value and competitive advantages, communication with potential buyers through a letter of intent, negotiating terms based on business valuation metrics like comparable company analysis, and finalizing a sale and purchase agreement.

3. How does the sell-side process timeline look in an M&A transaction?

It starts with preparing your business for sale by highlighting its equity value and competitive advantages. Then you engage an independent investment bank like Baird for credibility in presenting your business to potential buyers. After that comes the negotiation stage where terms regarding risk management and liquidity issues are discussed before signing off on the deal.

4. Why do we need sell-side m&a advisory services during this process?

Advisory services are crucial as they help minimize information asymmetry between buyer and seller while also managing risks associated with illiquid assets involved in these transactions.

5. Can e-commerce businesses go through the Sell Side M&A Process too?

Absolutely! Whether it’s about upselling your product line or strategizing better ways of onboarding new customers – every aspect can be improved upon by engaging in such processes which ultimately enhance shareholder value.

6. What happens after concluding a successful Sell-Side M&A Process?

After successfully closing out the deal, typically there’s some sort of transition period agreed upon during negotiations where both parties work together ensuring smooth operations continue post-transaction.

About ValleyBiggs